social security tax limit 2022

Fifty percent of a. We call this annual limit the contribution and benefit base.

Social Security What Are Maximum Taxable Earnings And What Are They For 2022

The wage base limit is the maximum wage thats subject to the tax for that year.

. The SSA also announced today that the maximum amount of earnings subject to Social Security tax also known as the wage base will rise 9 in 2023 to 160200 up from. Only the social security tax has a wage base limit. The rate consists of two parts.

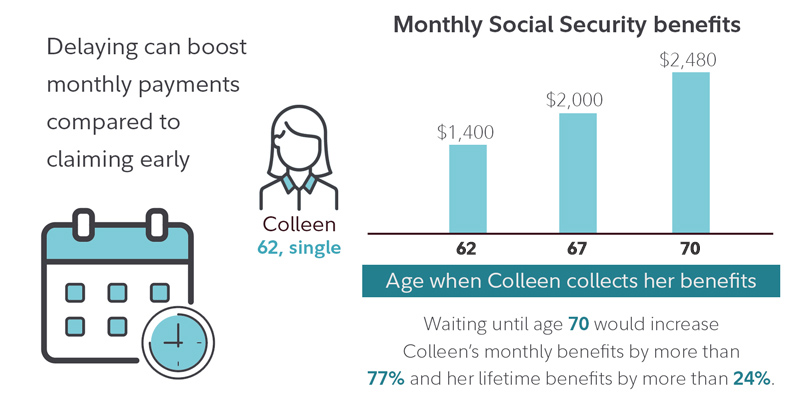

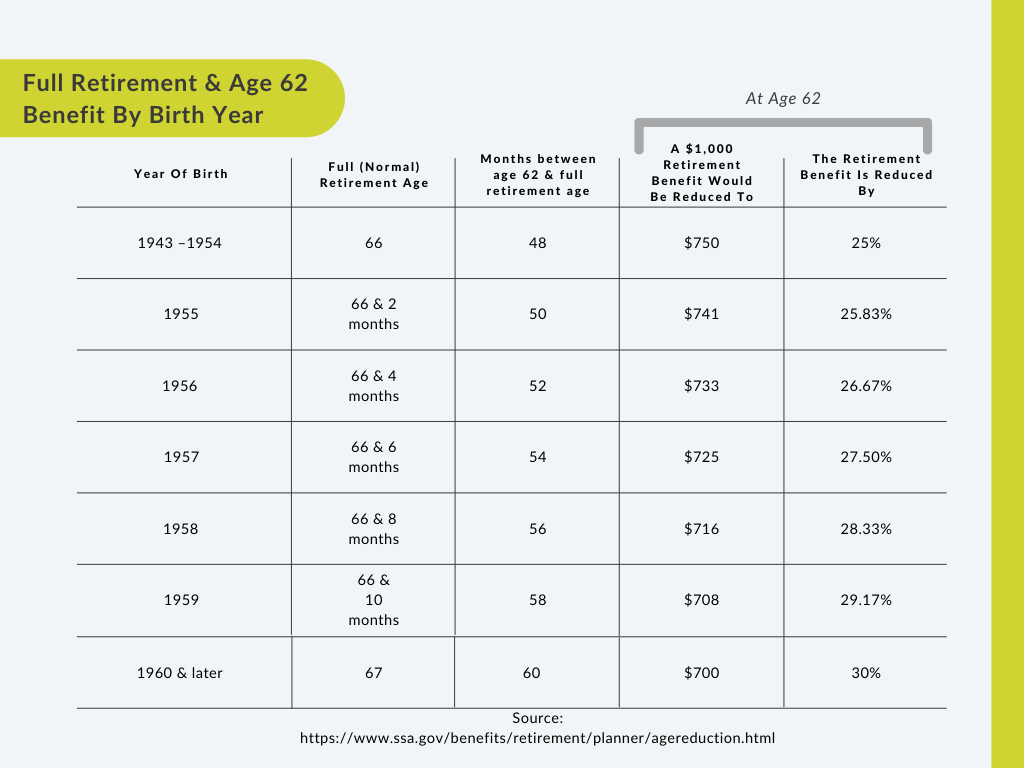

The exception to this dollar limit is in the calendar year that you will. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. For those claiming benefits at age 62 the maximum Social.

What is the income limit for paying taxes on Social Security. So for people making over 160200 in 2023 they will be paying 818 more in Social Security. For every 2 you exceed that limit 1 will be withheld in benefits.

If that total is more than 32000 then part of their Social Security may be taxable. Individual taxable earnings of up to 160200 annually will be subject to Social Security tax in 2023 the Social Security Administration SSA announced Thursday. The OASDI tax rate for wages in 2022 is 62 each for employers and employees.

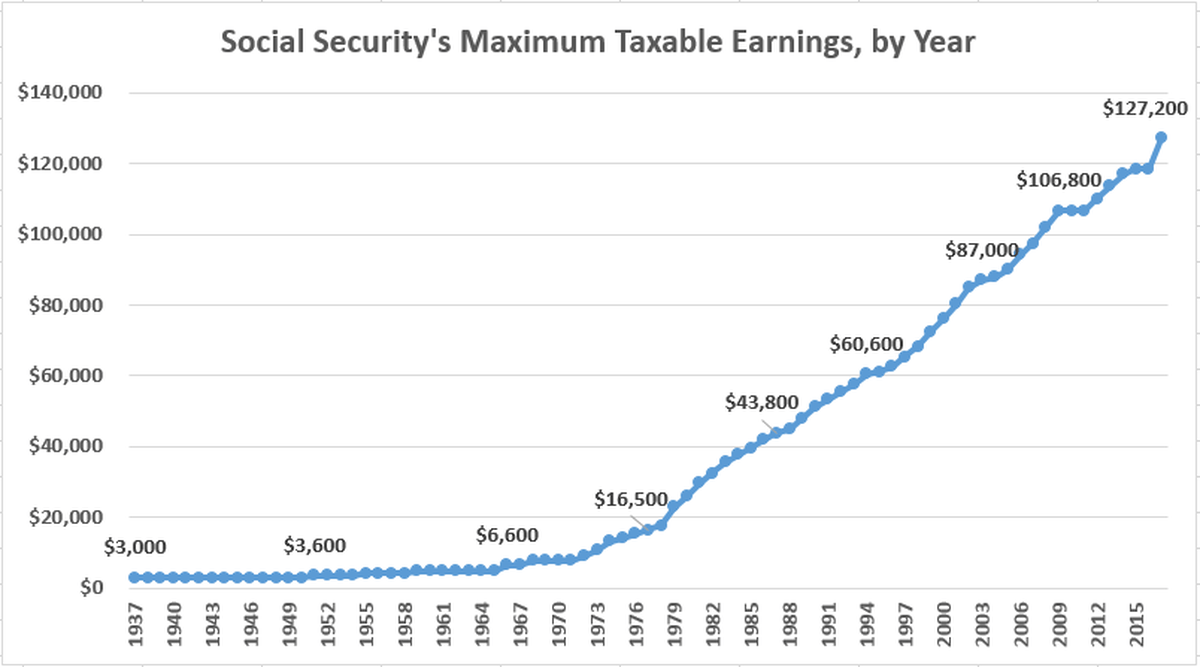

For earnings in 2022 this base is 147000. How to Calculate Your Social Security. Heres the bottom line.

For earnings in 2022 this base is. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see. The Social Security Administration SSA has announced that the maximum earnings subject to Social Security tax Social Security wage base will increase from.

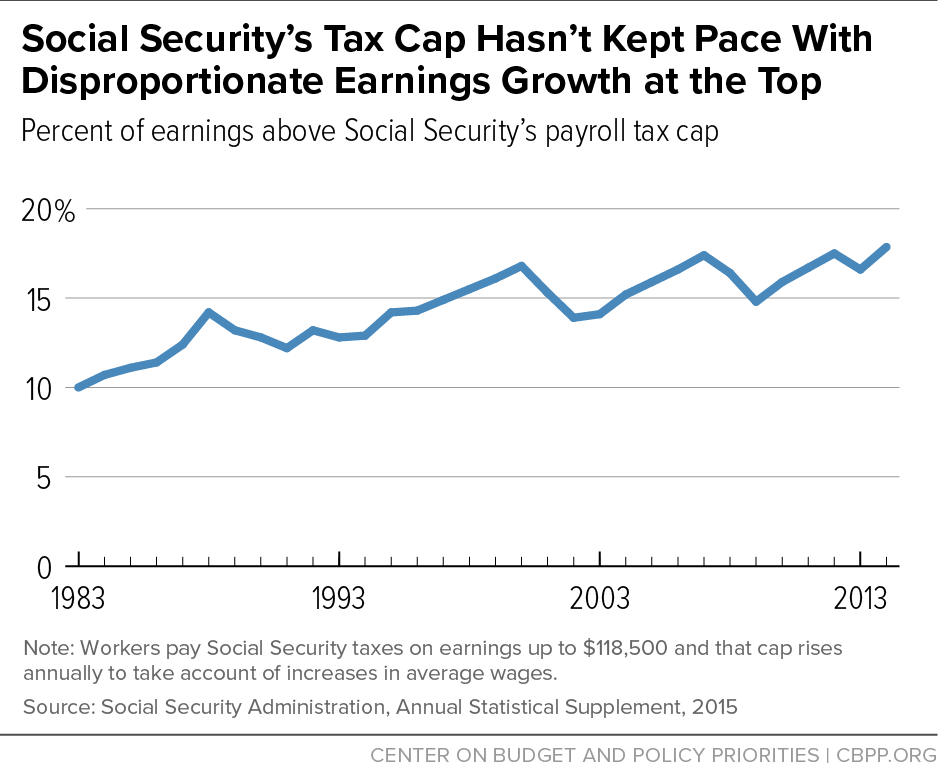

The rise in the social security payroll tax threshold from 127200 in 2017 to 147000 in 2022 indicates a 156 percent increase over the last five years. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must. 2 days agoWith the Social Security COLA of 87 for 2023 the new maximum Social Security numbers are going up next year.

For 2022 the Social Security earnings limit is 19560. If you collect Social Security early say at 62 and earn income from work that exceeds the income limit Social Security will deduct 1 from your. 1 day agoAs a result the maximum Social Security tax possible jumps from 9114 to 9932.

In 2023 the Social Security tax limit is 160200 up from 147000 in 2022. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is. According to a Fact Sheet on the SSA website the maximum Social Security benefit for someone retiring at full retirement age will rise to 3627 a month in 2023 from.

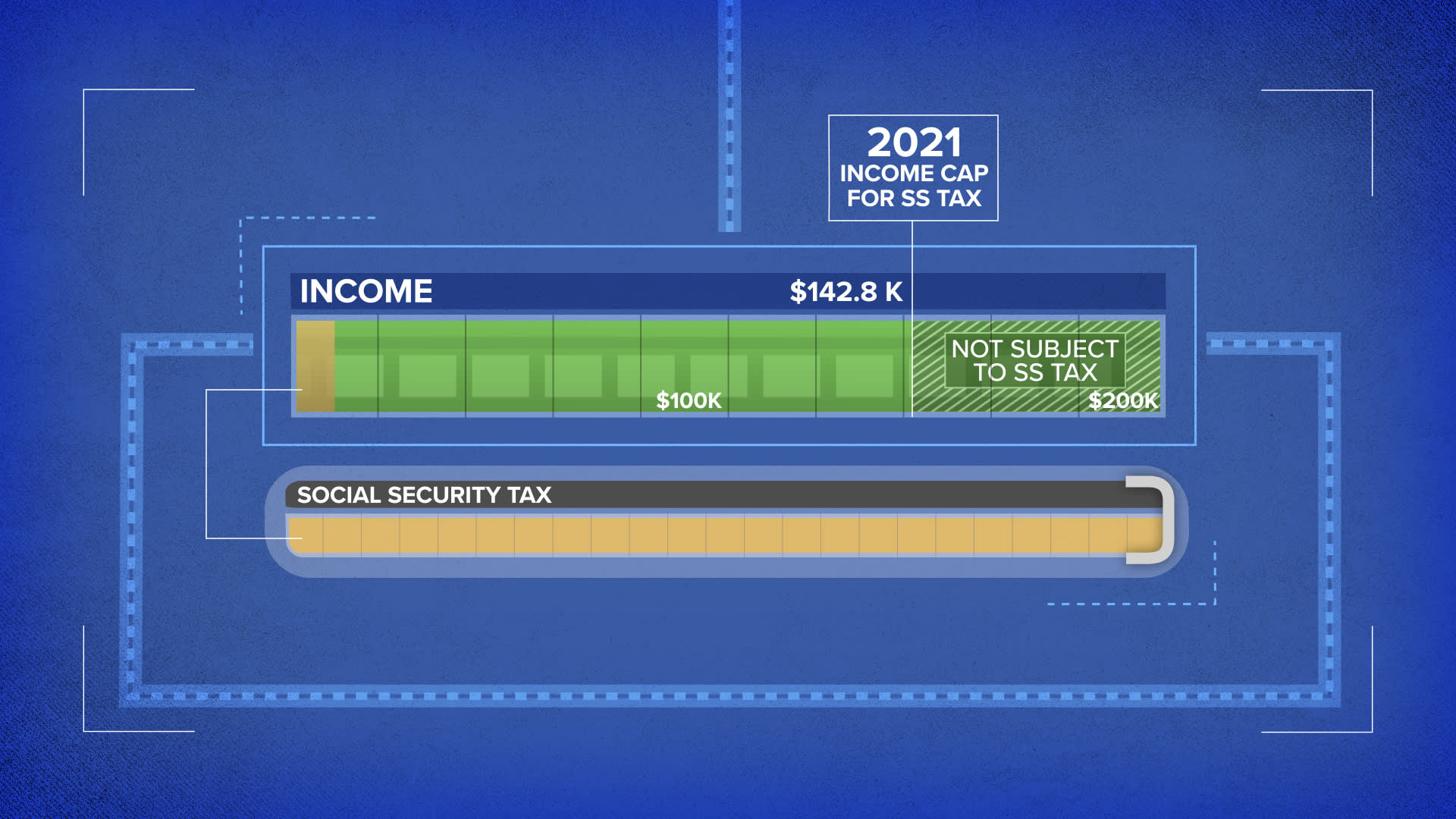

This amount is also commonly referred to as the taxable maximum. If a couple is married each person would have a 147000 limit. The federal government sets a limit on how much of your income is subject to the Social Security tax.

The 765 tax rate is the combined rate for Social Security and Medicare. That means an employee. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. However if youre married and file separately youll likely have to pay taxes on your Social Security income. The 2022 limit for joint filers is 32000.

The self-employment tax rate is 153. The OASDI tax rate for. 9 rows This amount is known as the maximum taxable earnings and changes each year.

Of 2021 through the third quarter of 2022 Social Security and Supplemental Security Income SSI beneficiaries will receive an 87 percent COLA for 2023. In 2022 the Social Security tax limit is 147000 up. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021.

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

2022 Social Security Taxable Wage Base Hrwatchdog

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Social Security At 62 Fidelity

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

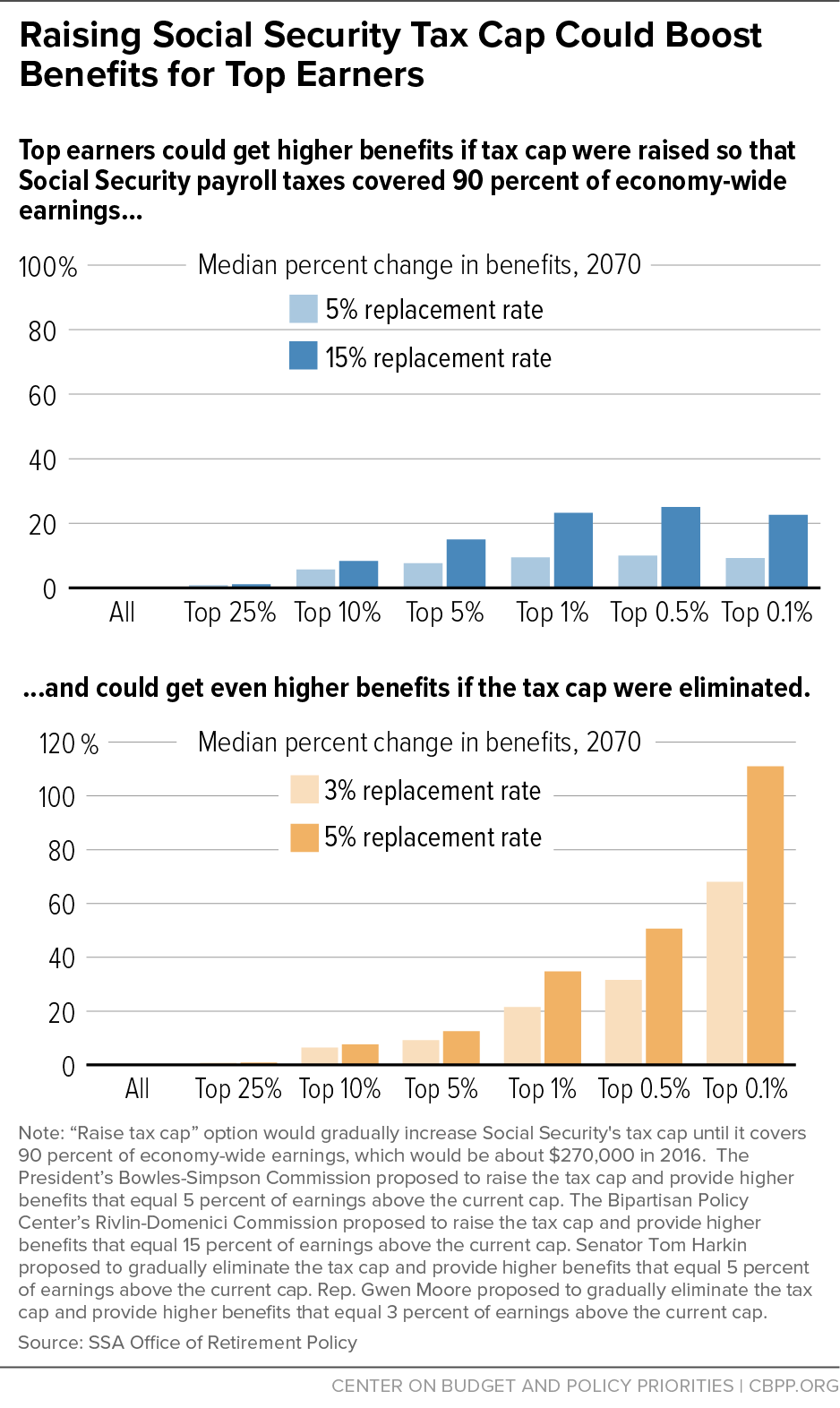

Raising Social Security Tax Cap Could Boost Benefits For Top Earners Center On Budget And Policy Priorities

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp

What Is The Social Security Wage Base 2022 Taxable Limit

Maximum Taxable Income Amount For Social Security Tax Fica

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

The Evolution Of Social Security S Taxable Maximum

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

Social Security Tax Limit Wage Base For 2020 Smartasset

Social Security Benefits Increase 2022 Changes Meetcaregivers

Social Security Tax Cap 2021 Here S How Much You Will Pay

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)