rhode island tax rates 2021

Rhode Island 2021 Tax Rates. The current tax forms and tables should be consulted for the current rate.

Ri Food Bank Status Report On Hunger Rhode Island Community Food Bank

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum. Any income over 150550 would be taxes at the highest rate of 599.

About Toggle child menu. Some of the most common are. Town Residential Real Estate Commercial Real Estate Personal Property Motor Vehicles.

The rate so set will be in effect for the calendar year 2020. Select year Select another state. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate Index. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

Your 2021 Tax Bracket To See Whats Been Adjusted. Rhode Island also has a 700 percent corporate income tax rate. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. The rate so set will be in effect for the calendar year 2021. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

2016 Tax Rates. Rhode Island Property Tax Rates. Integrate Vertex seamlessly to the systems you already use.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. State of Rhode Island Division of Municipal Finance Department of Revenue. Ad Get Rhode Island Tax Rate By Zip.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the extended filing due date of October 17 2022. Employees Withholding Tax Exemption Certificate. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount.

These rates include the 021 percent Job Development Assessment. Terms used in the Rhode Island personal. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

The customer must give you a completed Rhode Island sales and use tax resale certificate or one of several types of exemption certificates issued on or after July 1 2021. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount. Register as an employer on the Rhode Island BAR website.

Exemptions to the Rhode Island sales tax will vary by state. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

The income tax is progressive tax with rates ranging from 375 up to 599. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. Find your gross income.

4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. Rhode Island Tax Brackets for Tax Year 2021. Governor McKee also issued Executive Order 21-117 allowing the Department to hold the UI taxable wage base at the same level as it was in 2021.

Discover Helpful Information And Resources On Taxes From AARP. The rate for new employers which is based on the States five-year benefit cost rate for new employers will be 119 percent. Ad Compare Your 2022 Tax Bracket vs.

Rhode Island Income Tax Calculator 2021. Free Unlimited Searches Try Now. 2021 Rhode Island Taxes.

3 rows In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single. The rate for new employers will be 116 percent including the 021 percent Job Development Assessment. If the customer is a charitable or religious organization the customer must present a Rhode Island Exempt Organization Exemption Certificate.

Your average tax rate is.

Rhode Island Income Tax Calculator Smartasset

Best Criminal Justice Schools In Rhode Island

Rhode Island Aca Reporting Deadline Rhode Island Island Health Plan

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

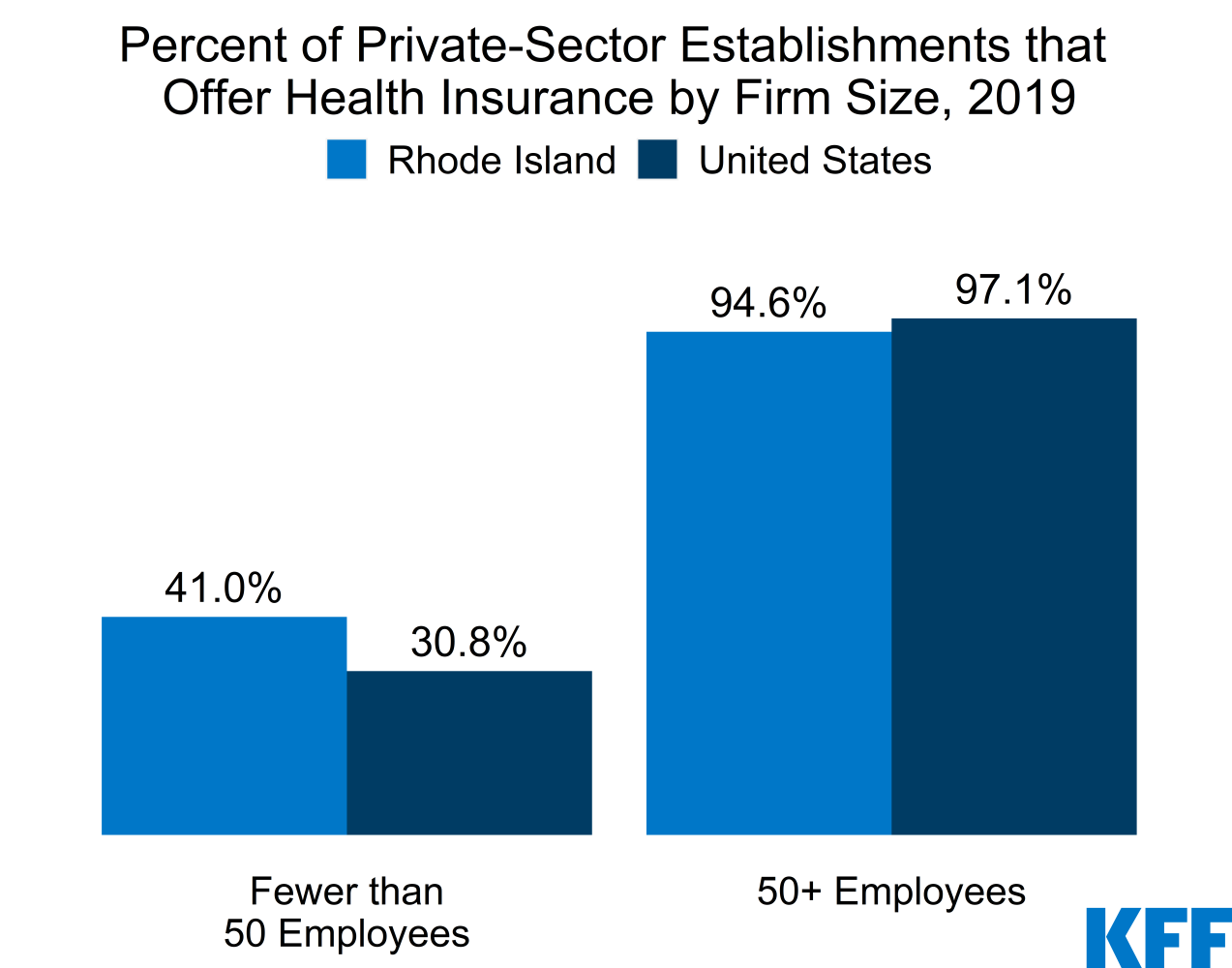

Election 2020 State Health Care Snapshots Rhode Island Kff

Rhode Island State Economic Profile Rich States Poor States

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

Rhode Island Estate Tax Everything You Need To Know Smartasset

Estate Tax Ri Division Of Taxation

Rhode Island Income Tax Brackets 2020

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

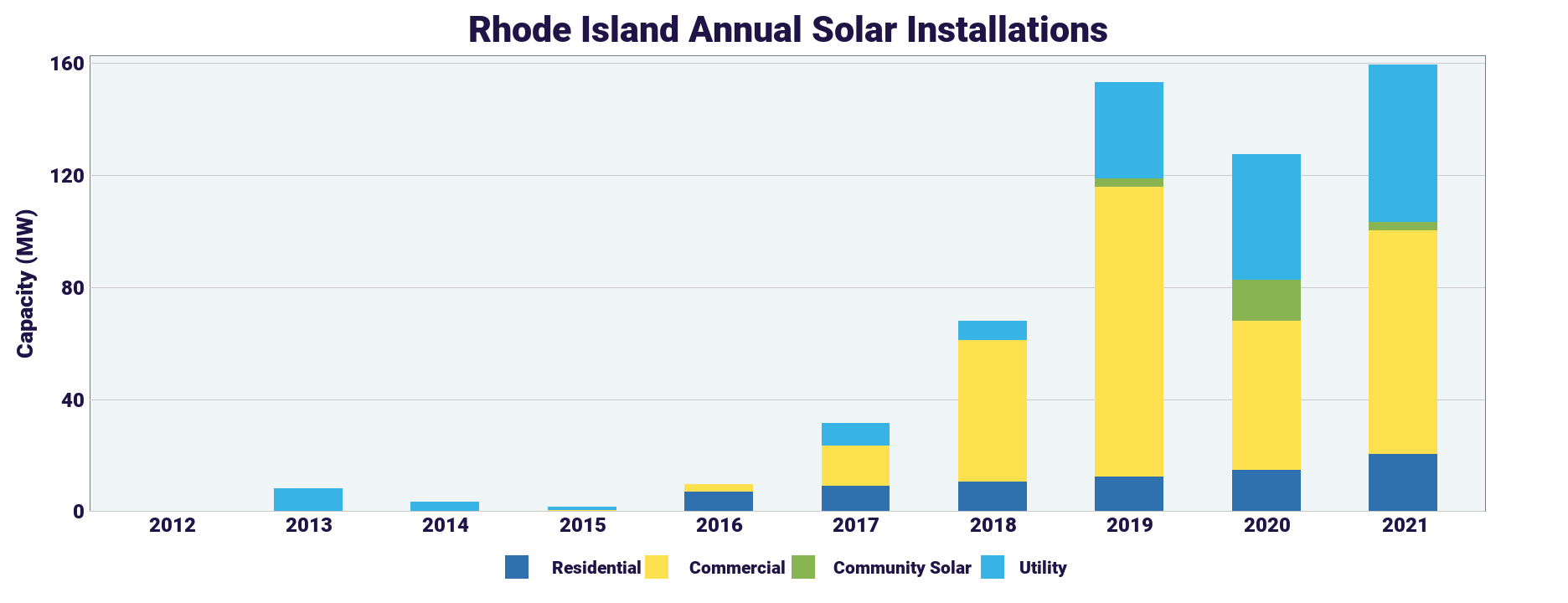

Rhode Island Limits Solar Power Property Taxes Pv Magazine Usa

Rhode Island Property Tax Rates Town By Town List With Calculator Suburbs 101

Rhode Island Political News July 2022 The Boston Globe